34+ is a reverse mortgage a good deal

Free Guide For Homeowners Age 61. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Profiling The Ideal Reverse Mortgage Candidate Sixty And Me

Web The best reverse mortgage lenders are available to borrowers with a range of credit scores and have several types of reverse mortgage options competitive rates and multiple payout options.

. Web Reverse mortgages really only have two pros You get some cash. Ad Can the loan improve your emotional and financial well being. The lender distributes the funds in a lump sum.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and interest. Web A reverse mortgage increases your debt and can use up your equity. A reverse mortgage loan like a traditional mortgage allows homeowners to.

But there are no monthly payments. Get A Free Information Kit. Reverse mortgages give you access to some cash you can use to pay for living expenses or in some cases anything your heart desires.

Reverse mortgages accumulate interest and fees like other types of home equity loans. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. A reverse mortgage is secured by the equity in your home and unlike a home equity line of credit HELOC it does not require any.

Ad Reviewed Ranked. There are no monthly payments. To educate yourself about the pitfalls of obtaining a reverse mortgage and to assess whether one is appropriate for your unique circumstances consider obtaining.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. With reverse mortgages lenders pay borrowers and. Ad Reviewed Ranked.

This article provides some tips to help you weigh your options and find the deal. Ad Search for Mortgage reverse. By their nature reverse mortgages involve unique risks.

Web The fact is reverse mortgages are exorbitantly expensive loans. Web The total number of reverse mortgage originations increased from 43000 to 59000 between 2020 to 2021 an increase of more than 36 according to the Consumer Financial Protection Bureau CFPB. Web A reverse mortgage is a type of home loan that allows homeowners that are 62 or older to take out some of their home equity and convert it to cash.

Web A reverse mortgage is a type of home loan that lets you convert a portion of the equity in your house into cash. Web Getting a Good Deal on a Reverse Mortgage Loan. Web A Home Equity Conversion Mortgage HECM the most common type of reverse mortgage is a special type of home loan only for homeowners who are 62 and older.

Web A reverse mortgage also known as a home equity conversion mortgage allows homeowners age 62 and older to convert the equity in their home to cash which can benefit them under certain circumstances. In addition to the age requirement you must. Web Legal Advice on Good Deals.

Web A reverse mortgageallows eligible homeowners to withdraw equity from their homes then use it as income during their lifetime. See if you qualify. Get A Free Information Kit.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Additionally youll pay a. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Your debt keeps going up and your equity keeps going down because interest. Free Guide For Homeowners Age 61. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Web A reverse mortgage is a loan that allows senior homeowners 55 to borrow up to 55 of the value of their home. Web A reverse mortgage can give older homeowners the funds they need to help cover their costs of living.

Ad Dedicated to helping retirees maintain their financial well-being. Is it right for you now. With regular mortgages borrowers make monthly payments to pay down the debt.

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. If youre considering a reverse mortgage its important to shop around to compare your options and the offered terms. Web A reverse mortgage typically lets you borrow up to 60 of your home equity but the actual amount you take out depends on a few factors including your age appraised home value and financial.

Web A reverse mortgage is meant for homeowners who have paid off their mortgage or who have accumulated a lot of home equity. Like a regular mortgage youll pay various fees and closing costs that will total thousands of dollars. While this can certainly sound like a good deal theres a lot to consider before.

Reverse mortgages frequently are marketed to retirement-age homeowners who want more money to cover living expenses but still want.

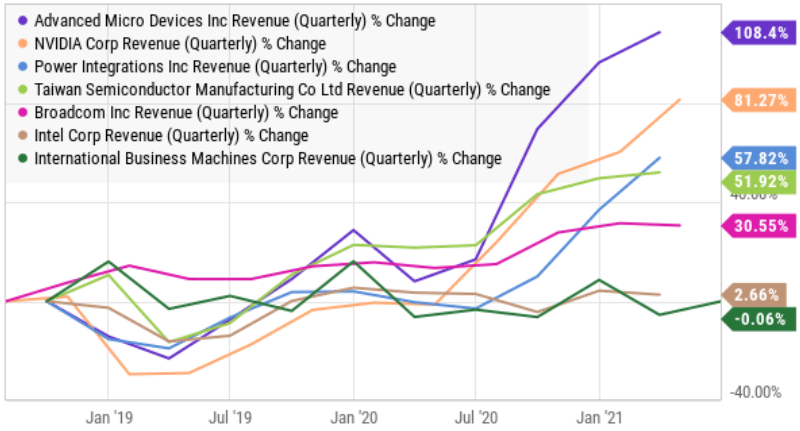

Intel Is Ugly Q2 2021 Earnings 3 Better Chip Stocks To Own Nasdaq Intc Seeking Alpha

Real Estate This Week July 15th 2016 By Kamloopsthisweek Issuu

Qprwioxd5jj Am

Is A Reverse Mortgage A Good Deal For You Youtube

Reverse Mortgage Calculator

Aggregate 91 About Investment Calculator Australia Best Daotaonec Edu Vn

Warning Reverse Mortgage Downsides Disadvantages

Glenn E Grant Mortgage Loan Officer Maxwell Mortgage Team Linkedin

Reverse Mortgage Net

Why The Lowest Reverse Mortgage Rates Offer Most Money Reversemortgagereviews Org

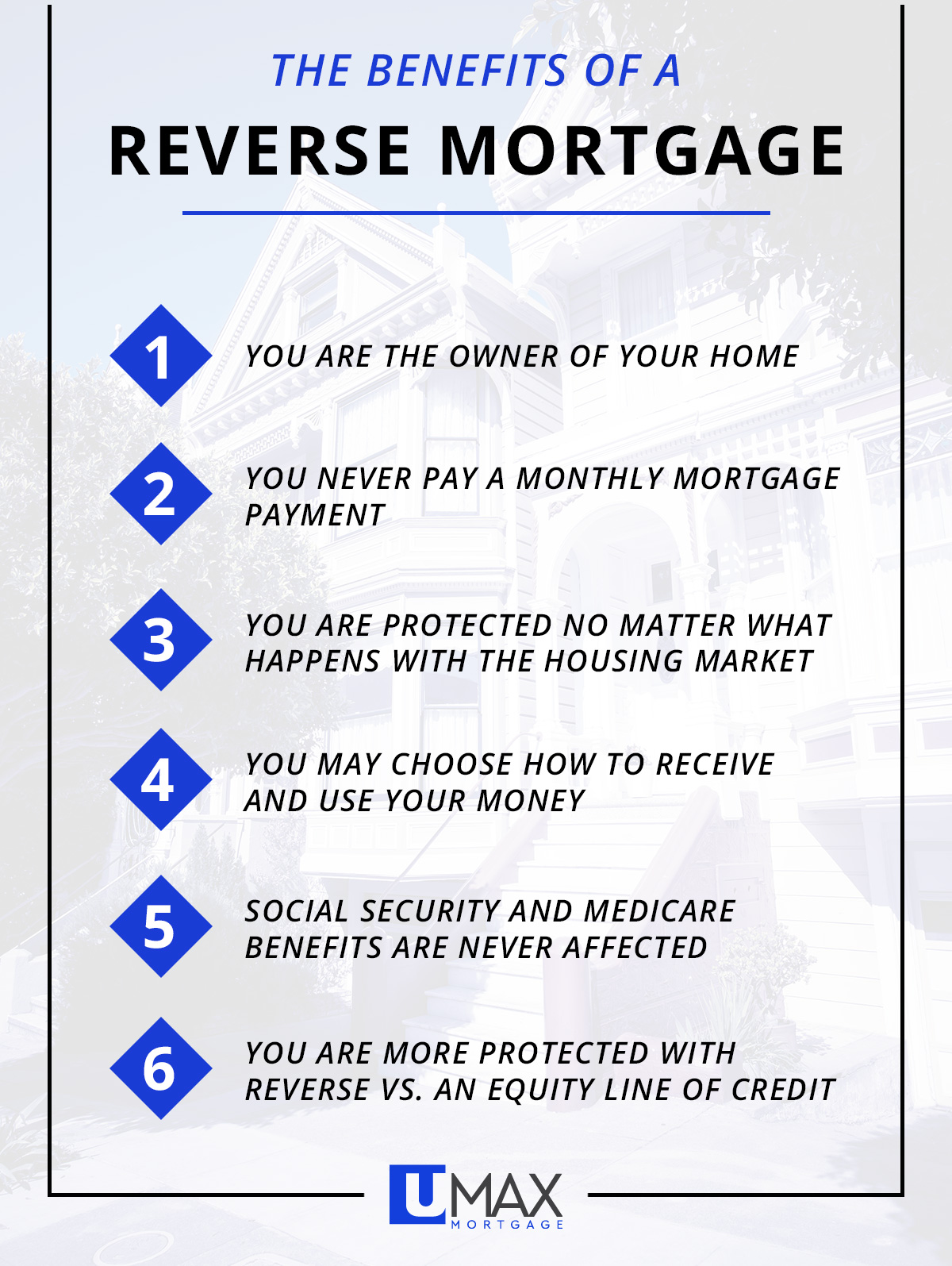

Reverse Mortgage Solutions Learn The Benefits Of Reverse Mortgages In California Umax Mortgage

How Much Money Can I Get From A Reverse Mortgage

Reverse Mortgage Pros And Cons Bankrate

Is A Reverse Mortgage A Good Deal For You Youtube

Jessica Rix Mortgage Broker In Mildura Mortgage Choice

:max_bytes(150000):strip_icc()/GettyImages-1342608768-3f5ecb301b5e48968d2d514eb3406abc.jpg)

How Much Can You Get From A Reverse Mortgage

How Much Money Can I Get From A Reverse Mortgage